The charts included in this short note, indicate that the early part of 2010 has seen consumer confidence indicators experienced a decline in Canada, France, Italy and the United Kingdom, while continuing to recover in Japan, Germany and the United States. As a result of these diverging trends among the G7 countries, consumer confidence has been slowing on average in the OECD area.

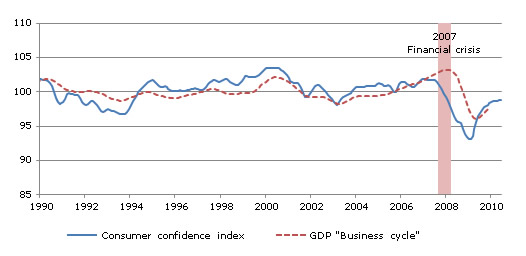

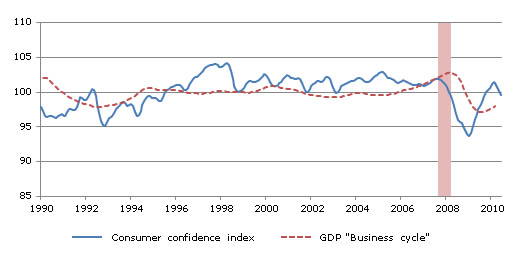

OECD Area

Consumer confidence level in the OECD area has stabilised since January 2010, possibly announcing a potential peak (however still somewhat below the long-term average of 100) or just that consumers are unsure of how recent economic events and new government policies will impact on them individually. Overall, the presence of remaining low confidence levels could indicate that the results of the financial crisis are still being felt and that consumers in the OECD area have reservations about their economic future.

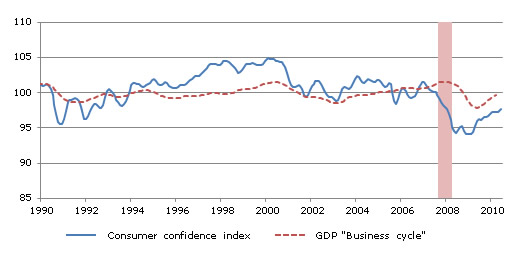

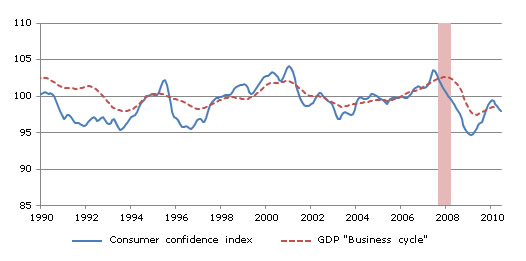

United States

Consumer confidence in the United States hit a historic low in February 2009; this was followed by a small improvement to December 2009 that has continued into the first half of 2010. The consumer confidence index is still at a low level, very close to the level recorded during the 1990's recession. This low level of consumer confidence can possibly be explained by the following economic indicators: the volatility of the stock market (NYSE); a national unemployment rate that has hovered around 9.7% since January 2010; and the indicator 'work started for dwellings' that after a small improvement decreased by 10% in May 2010 while remaining at visibly low levels.

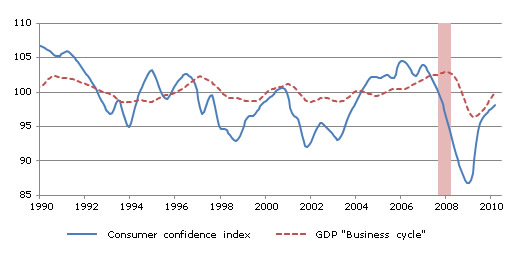

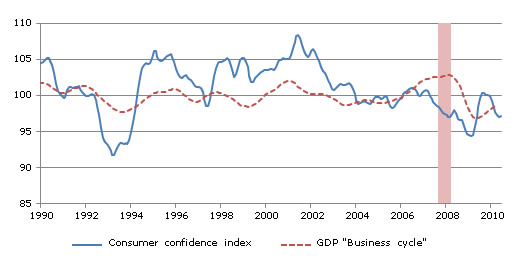

Japan

Since its historic January 2009 low, consumer confidence in Japan continuously increased. However, for the first time and starting in October 2009 this pace of growth is slightly slowing. Looking at the Japanese economic variables we see that after a small pause during the first two months of 2010 unemployment has started to rise again. Even exports, after a year of strong growth since February 2009, have shown a recent slowdown in their pace of growth. After the financial crisis, stocks of manufactured investment goods continued to decrease in the Japanese market. The TOPIX share index, which has remained at very low levels after the crisis, has from the last quarter of 2009 become very volatile. These factors may be having a damping effect on consumer confidence.

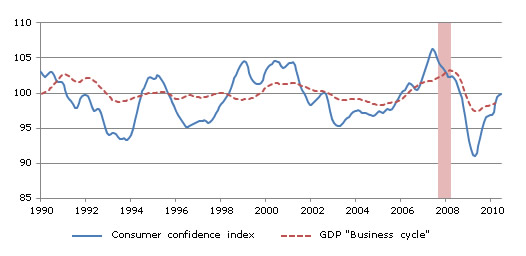

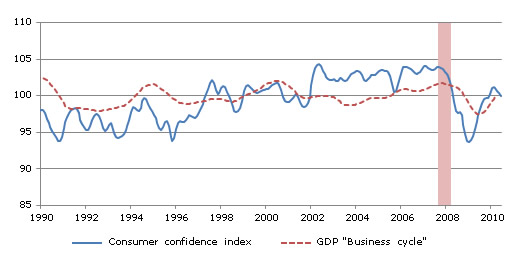

Germany

The consumer confidence index for Germany has significantly improved since April 2009 and in the 2nd quarter 2010 finally reached its long-term average (100). From an economic point of view, the German economy since June 2009 has seen a decreasing trend in its unemployment rate. This combined with the fact that for more than a year, export growth has been trending upward, could possibly be having a general positive effect on German consumer sentiment. The weakness of the euro compared to the dollar also boosted German exports. But there is a need to be cautious as German exports decreased for the first time in April 2010, the spread of German interest rates peaked in January 2010 (2.58%), and the German government just recently took the decision to drastically decrease the public deficit and to save €80 billion in public spending by 2014. All these events may have an impact on future German consumer confidence and strengthen any potential doubt among German consumers about their near future.

United Kingdom

Consumer confidence in the United Kingdom peaked in February 2010 and has been declining significantly since then. From the end of 2007 the unemployment rate in the United Kingdom has consistently climbed and now sits at 7.9 percent for March 2010, a situation which must be having an impact on job security in the country. For the first time since 1988, savings in the United Kingdom exceeded new borrowings indicating that consumers are starting to tighten their belts. All these events, added to the new government's priorities on spending cuts and tax increases, creates a context that makes consumers more pessimistic about their economic outlook and will continue to negatively impact on the UK consumer confidence indicator.

France

Consumer confidence in France reached a peak in January 2010 and has lost more than 1 point since then. Although the sharp depreciation of the euro has made French exports more competitive this hasn't been reflected in the French consumer confidence indicator. Since April 2008, the French unemployment rate has continued on an upward trend but now seems to have stabilised at 9.9% since the beginning of 2010. The indicator 'work started for dwellings' decreased by more than 22% between March 2010 and May 2010. The Paris Stock Exchange, SBF 250 industries, lost almost 10% from April to June 2010. These indicators combined with recent announcement of budget cuts by the French government could be expected to have a downbeat impact on consumer confidence.

Italy

Consumer confidence in Italy peaked in September 2009 and has lost more than 3 points to May 2010. Since April 2007, the Italian unemployment rate has continued to increase, rising by 2.5 percentage points in the three years to 2010 but since March 2010 has stabilised at 8.7%. In May 2010 Italy adopted large budget cuts to drastically reduce public debt. Since 2008 the construction sector first decreased by 11% in 2009 and then by 6% in the first quarter of 2010. The number of total car registrations in Italy decreased by 24% between March and June 2010. Italian share prices, the MIB Storico Generale index, fell by more than 12% between April and June 2010. These events probably help to explain the drop in consumer confidence in Italy since September 2009 but the recent stabilisation in some economic indicators point to an uncertainty in the future Italian consumer confidence indicator.

Canada

Consumer confidence in Canada peaked in February 2010 and has been consistently declining since then. Although some positive signs are still visible in the job market (the unemployment rate has decreased since August 2009 from 8.7% to 7.9% in June 2010), other economic indicators are decreasing: permits issued for dwellings decreased by 13% between March 2010 and May 2010, the number of car registration dropped also by 13% between February and April 2010, and the S&P/TSX composite index (the share market) decreased by almost 8% from April to June 2010. These events may indicate that Canadian consumers may become less confident in the Canadian economy and their future prospects.