"Market variance and investor uneasiness grew in February with inflation concerns mixed prior to the market turmoil, and growing with the added fears of currency and trade volatility," says Howard Silverblatt, Senior Index Analyst at Standard & Poor's. "Countries and sectors began to move in opposite directions after the initial drop in the Shanghai Composite, and their performance is expected to be based on the health of their local markets more so than on global issues such as oil, interest rates and currency rates."

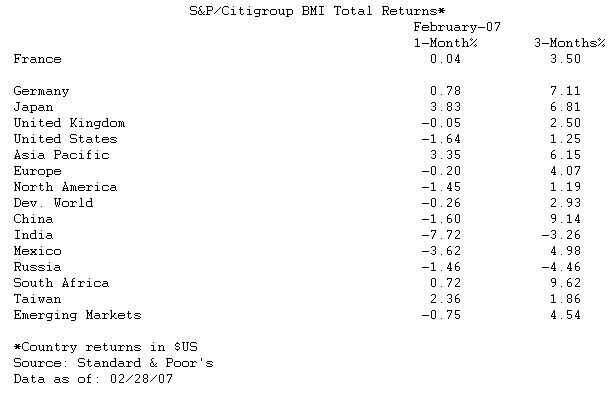

For February, 13 of the 27 developed markets posted an average gain of 2.73% and an average loss of -1.29%. South Korea rebounded in February with a 4.15% gain compared to a loss of 5.96% last month. Iceland continued its impressive returns with a 7.51% gain, resulting in 21.52% for its 3-month return. The emerging markets were more varied, with 12 gaining (+6.45%) and 14 declining (-2.71%). Venezuela reversed last month's politically induced decline to post an 18.65% gain from a -33.95% return in January. Peru continued its year-plus upswing with a 14.69% monthly gain, resulting in a 1- year return of 103.84%.

Only half of the 10 sectors showed gains in February. The wide variance is due to the United States' impact as the largest equity market in the world. Consumer Discretionary, which was down 0.23% worldwide, was up 1.66% Ex-US, reflecting the S&P 500's 3.04% drop. Similarly, Information Technology had a 1.68% worldwide decline, but a more modest 0.42% Ex-US loss.

Oil prices continued to rise in February, closing at $US 61.30 up from January's $58.14; and gold, the traditional safe haven in turmoil, closed up $US 672.50 versus January's $657.90. Value stocks continued to outperform Growth, posting a slight loss for the month of 0.09% versus a decline of 0.42% for Growth stocks.