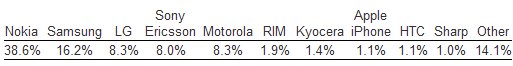

* The largest gainer in market-share was Samsung with an increase of +2.7% (2008: 16.2%). Samsung had a faultless four quarters, driven by handsets such as the Omnia and Ultra series.

* The next significant gainer was Nokia with +1.8% (38.6%). Most of those gains, however, were secured in the first half of the year. Market-share started to slide in the second half and 4Q in particular as emerging market growth stalled.

* LG secured a +1.5% increase for an 8.3% share, in particular gaining significant traction in the North American market.

* “While those three manufacturers dominate the global market, it probably would not come as a surprise to many that RIM (Blackberry) and Apple (iPhone) boldly moved up in the market-share stakes with growths of 0.9% and 0.8% respectively,” notes Kevin Burden, Practice Director for Mobile Devices. Despite the tough economic climate, these two players are likely to continue their march to the consumer centre-stage but it in a way that does not drop their handset ASPs to bargain basement levels. HTC was late entering the consumer smartphone market with the Android-based G1, but the vendor has significant contracts in place (such as T-Mobile) which should play to the its advantage in 2009.

* The vendor with the most significant loss in market-share was Motorola with –5.1% in 2008 (8.3%). This is an improvement on 2007 in which the firm suffered a –7.8% drop, but it underscores the urgency for Sanjay Jha and Motorola’s senior management to deliver robust selling products in 2009. It will be a tough year for Motorola but it needs to deliver handsets that draw back the once faithful Motorola purchaser before it is truly too late. The challenge is that purchasers in 2009 will be very, very picky.

* Sony-Ericsson also stumbled in the mid part of 2008 with a -0.7% contraction in market-share. The release of Experia 1X in 4Q and related smartphone products could help the vendor improve market share in 2009.

“Sharp revisions to country-by-country economic conditions in the space of just three months will likely mean that a YoY handset shipment contraction of between -5% and -10% is becoming a distinct possibility,” concludes Saunders. “What is certain is that handset vendors will be trying to convince everyone they should own a smartphone. Welcome to the Year of Smartphone.”