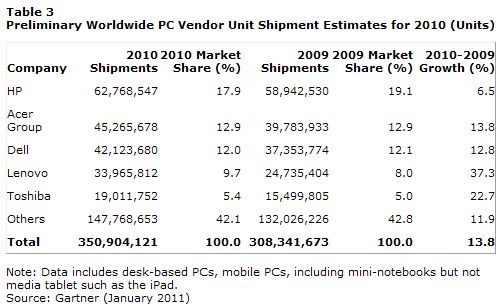

HP maintained the No. 1 position in worldwide PC shipments in the fourth quarter of 2010, but its shipment growth was below the worldwide average (see Table 1). The preliminary results showed that HP’s professional business had solid growth, but it was offset by a weak consumer PC business in the U.S. However, HP did well in the Europe, Middle East, and Africa (EMEA) professional and consumer markets. Asia/Pacific continued to be a challenging region for HP.

Acer faced challenges in the fourth quarter of 2010 due to a slowdown in the overall consumer mobile PC market. The company was impacted by a weakening mini-notebook segment. Due to a lower presence in the professional PC market, Acer could not benefit from the professional PC refresh demand.

Dell benefitted from professional PC refreshes across key regions. Dell’s shipment growth was better than regional averages across most regions. Dell’s weaker presence in the consumer segment meant the company was not affected as much as some other vendors due to disappointing holiday sales. Lenovo marked the strongest year-on-year growth among the top 5 vendors. Lenovo’s strength was derived from the replacement purchases in the professional PC market, as well as its on-going efforts of getting into the consumer market.

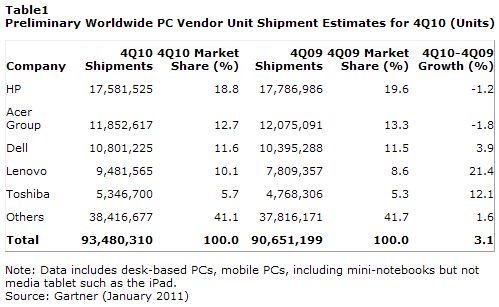

In the U.S., PC shipments totaled 19.1 million units in the fourth quarter of 2010, a 6.6 percent decline compared to the fourth quarter of 2009 (see Table 2). This is better than Gartner’s earlier projection of a 10 percent decline for U.S. PC shipments in the fourth quarter of 2010.

“U.S. holiday sales were not fantastic for most PC vendors, but the professional market did show healthy growth during the quarter,” Ms. Kitagawa said. “Media tablets undoubtedly intensified the competition in the consumer market. These devices do not replace primary PCs, but they are viewed as good enough devices for these who want to have a second and third connected device for content consumption usage. Mini-notebook shipments were hit the most by the success of media tablets.”

HP continued to lead the U.S. PC market, accounting for 29.3 percent of PC shipments in the fourth quarter of 2010. Gartner’s preliminary study shows that Toshiba and Apple were the only vendors in the top 5 to increase shipments, as Toshiba’s shipments grew 14.4 percent, while Apple’s shipments increased 23.7 percent.

PC shipments in EMEA totaled 32 million in the fourth quarter of 2010, a 6.2 percent increase from the fourth quarter of 2009. The consumer market in Western Europe remained weak throughout the quarter. In a weak economic environment, already restrained consumer wallets shifted away from PCs to other consumer electronic devices including media tablets, gaming machines and e-readers. The professional market seemed to be picking up, but PC pricing remained an issue as increased EURO/Dollar exchange rates limited any price reductions, resulting in limited year end demand uplift.

In Asia/Pacific, PC shipments reached 27.9 million units, a 4.1 percent increase from the fourth quarter of 2009. Fourth quarter PC shipments were primarily affected by the decrease of shipments into the consumer market. Consumer buying has become more discretionary with buyers both adopting a wait and see attitude due to the distraction of media tablets and cautious due to lack of confidence on the recovery of the world economies.

The PC market in Latin America grew 15 percent in the fourth quarter of 2010 as shipments totaled 8.9 million units. Mobile PC shipments increased 17.1 percent in the quarter, and desk-based PC shipments grew approximately 12.6 percent.

PC shipments in Japan grew 3 percent in the fourth quarter of 2010, as shipments reached 3.8 million units. The market experienced a late boost from demand of XP preinstalled PCs from dealers/resellers in October.

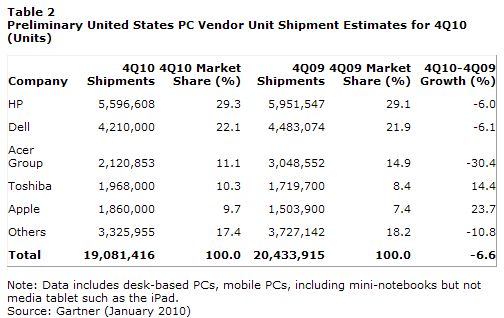

For the year, worldwide PC shipments totaled 350.9 million units in 2010, a 13.8 percent increase from 2009 (see Table 3). This growth rate was an improvement from 2009 when PC shipments increased 5.5 percent.

Among top 5 PC vendors, Lenovo’s shipment growth well exceeded the worldwide average. Lenovo’s growth was driven by strong professional growth as well as expansion into consumer space outside of China.