"Longer-term, public-sector spending will be curtailed in Europe as governments struggle to bring budget deficits under control during the next five years and to reduce debt during the next 10 years," Mr. Gordon said. "Private-sector economic activity will also likely be hindered because of the direct impact of austerity measures on key government suppliers and the indirect impact caused by the 'ripple effect.' An effective policy response will be critical to stimulate investment in general and in IT in particular."

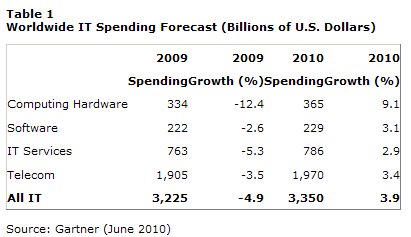

Worldwide computing hardware spending is forecast to reach $365 billion in 2010, up 9.1 percent from 2009 spending (see Table 1). "The computing hardware sector continues to benefit from a healthy PC sector, which accounts for two-thirds of total spending in this area, and we expect PC shipments to remain robust throughout 2010 and 2011," Mr. Gordon said. "Consumer shipments will continue to be powered by strong mobile PC uptake, while professional shipments will be buoyed by a new replacement cycle and migration to Windows 7."

In software, IT services and telecommunications, the appreciation in the value of the U.S. dollar, especially against the euro, has acted to dampen U.S.-dollar-denominated growth in 2010.

"Our latest IT spending forecast reflects the fact that the global economic outlook is stable but vulnerable to shocks in key regions and industries, which means that IT spending decisions are still scrutinized for value," Mr. Gordon said. "CEOs are targeting 2010 as a 'return to growth' year, and to enable growth strategies, CFOs expect increased IT spending. However, CIOs are seeing only marginal increases in budgets and are constrained to essential enterprise IT spending with discretionary spending still on hold. In the consumer sector, confidence is improving, although consumers are still wary of the threat of unemployment."