"The departure of a major player allows other vendors to fill the gap and increase shipments. But the market as a whole is still contracting and other vendors, with fewer resources and less distribution, may be forced to withdraw from the market altogether," says Ramon Llamas, research analyst with IDC's Mobile Devices Technology and Trends team. "With double-digit negative growth continuing to characterize the market, IDC expects the handheld device market to contract further before it reaches a stable point."

"Despite the ongoing decline, there continues to be a small but nonetheless significant demand for these devices," continues Llamas. "To drive ongoing demand, vendors have introduced a number of devices that offer features like multimedia, GPS, and wireless, but not cellular, connectivity. But even the inclusion of these new features have not stemmed the decline in shipments. Stability has yet to arrive."

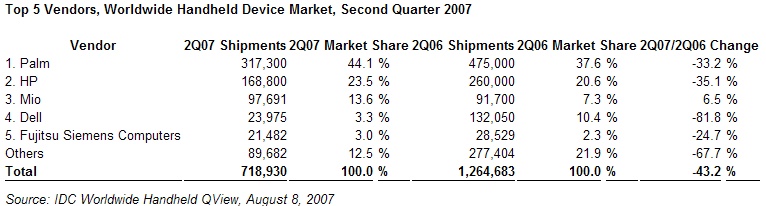

Top Five Handheld Device Vendors

Palm maintained its position as the number 1 vendor worldwide, and its shipments for the second quarter were nearly double that of the number 2 vendor HP. In addition, Palm posted a sequential increase in shipments, bringing to a halt the three consecutive quarters of sequential decline. But even the market leader was not immune to a year-on-year decrease in shipments, as the company relied on devices, like the Z22 and the TX, that have been available for nearly two years.

HP was the clear number 2 vendor by the end of the second quarter, and although it posted both a sequential and year-on-year decline, the company pointed out that its volumes were larger than expected, the result of filling in the gap created by Dell's imminent departure from the market. HP has also been experimenting with optimized handheld devices, including the iPAQ rx 4240 for multimedia and the iPAQ rx 5915 for GPS. Both devices carried a higher price point compared to simple handheld devices, but still moved the handheld devices in a new direction.

Mio posted its fourth consecutive quarter of year-on-year growth, bucking the general trend of the industry and that of the other major vendors. To do this, Mio has relied on the popularity of its P550, P350, and A201 devices, all of which feature a GPS receiver, spreading beyond its home territory of Asia/Pacific and into nearby Europe and Japan. Only recently has the company begun targeting North America.

Dell continued the phase-out of its Axim devices in 2207, as the company's shipments decreased 81.8% from the same quarter a year ago. Dell managed to remain among the top five vendors, but only barely as a number of smaller, regional vendors came within range of Dell's volumes for the period.

Fujitsu-Siemens Computers took fifth place in the second quarter, and did so by concentrating its shipments primarily into Western Europe, unlike other vendors which benefited from a global footprint. While the company has offered both simple devices, like its C Series, and GPS and multimedia-enabled devices, like its N100 Series, it also recently began offering a competing converged mobile device with its with its T Series device.