"There certainly is no sign that higher prices are leading OPEC producers to put more oil on to the market," said John Kingston, Platts Global Director of Oil. "To the contrary, the steps the group took several months ago to restrain output are still firmly in place. And with the third and fourth quarters, which are historically demand-growth periods, just months away, it won't be long before the group will be confronted with the question of whether to put more oil on to the market."

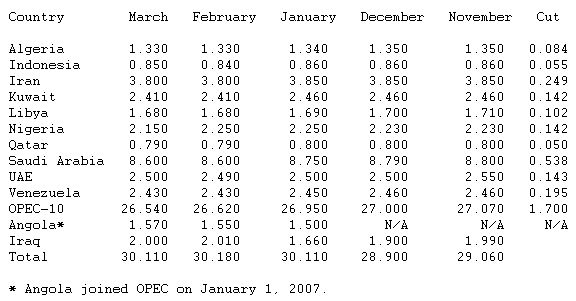

Among the OPEC-10, there were small output increases from Indonesia and United Arab Emirates (UAE), but Nigeria, following the latest attack on oil facilities in the Niger Delta, saw overall production fall by about 100,000 b/d.

Iraqi volumes were slightly down on February, while Angolan production continued to rise.

OPEC ministers agreed last October to remove 1.2 million b/d of crude from world oil markets beginning in November, saying supply was well in excess of demand and setting a production target of 26.3 million b/d. In December, they agreed to expand the cut by 500,000 b/d from February, bringing the target to 25.8 million b/d. The cuts were based on estimated September production of 27.5 million b/d.

The latest survey shows that the OPEC-10 have cut supply by some 1.27 million b/d since September, when Platts estimates pegged production at 27.81 million b/d.