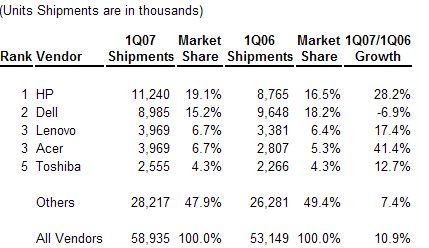

"The strong first quarter is a good indicator of the health of the industry," said Loren Loverde, director of IDC's Worldwide Quarterly PC Tracker. "The United States and Japan didn't grow much in the first quarter, but solid gains elsewhere and a boost from Vista brought us back to double-digit growth. The key market drivers – portable adoption and consumer demand – continue at a healthy clip, and commercial replacements should contribute more in coming quarters. Growth is likely to stay in double-digits over the next two years although it will be concentrated in Portables and international markets."

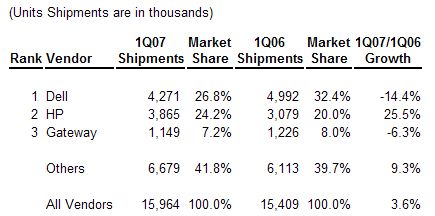

"As expected, the U.S. market saw a low single-digit year-on-year increase and a typical seasonal decline from Q4 to Q1. Contracting desktop demand and strong notebook activity remained the dominant trends," said David Daoud, manager of Personal Computing and PC Tracker Programs "The shift to Portables and related changes in various segments will force vendors to re-evaluate their channels and go-to-market strategies to adapt to the new market dynamics. Some of this restructuring has already begun, but it is likely to accelerate as Dell evaluates recent losses and vendors such as Acer and Lenovo change their strategy for the U.S. market."

Regional Outlook

* United States saw growth return to positive territory as HP made the most of consumer demand while Dell and Gateway continued to lose ground. Lenovo, which has struggled in the U.S. since taking over IBM's PC division, leveraged strong Portable sales to grow shipments by 12%. Dell remained the market leader, although its lead over HP has fallen from more than 12% share through the first half of 2006 to less than 3% this quarter.

* EMEA growth rose several points in 1Q07 on strong Portables demand. Desktop volume remained roughly flat from a year ago, but continuing demand for Portables across the region, and particularly in the Consumer segment and in CEMA, boosted overall growth. Market leaders HP and Acer continued to gain share with Toshiba, Packard Bell, and Asus also registering strong growth. Dell continued to suffer from slower corporate demand and retail competition in the consumer space and saw volume fall marginally from a year ago while Fujitsu Siemens and Lenovo shipments increased but trailed the market.

* Japan saw volume decline slightly from a year ago as commercial demand remained limited and competition from other products cut into consumer growth. Nevertheless, growth improved from a double-digit year-on-year decline in the fourth quarter.

* Asia/Pacific (excluding Japan) looked healthy with the strongest growth in a year. Portables remained a major driver, particularly in Southeast Asia, while Desktop growth also slightly outpaced expectations with a strong showing in China among other countries.

Vendor Highlights

* HP continued to grow at a rapid pace by leveraging its Consumer and Portables business and capitalizing on Dell's disarray. The company improved on a strong fourth quarter performance with growth of more than 28% in the first quarter, expanding its share of global shipments to 19.1% and widening its lead against rival Dell to 3.9 points. The strong showing for HP included growth of more than 25% in the United States, representing substantial share gains domestically, as well as nearly 30% growth abroad.

* Dell continued to struggle with a slow U.S. market and internal restructuring. A focus on the slower growing commercial market and a strategy of not chasing share at the expense of profitability while facing aggressive competition from HP and other competitors has reduced growth dramatically. Similar to the fourth quarter, Dell shipments declined by more than 14% in the United States and grew by just over 1% internationally. As a result, overall shipments declined by 6.9% year on year and international shipments rose to 52% of volume. Although Dell's Portable business saw healthy growth internationally, domestic sales were down. Dell's limited presence in retail was also a key factor as consumer shipments declined rapidly while commercial volume was more stable.

* Lenovo had a very solid quarter, boosting growth in the United States to more than 12% from –7% in 4Q06 and growth in Europe to 14% from 3% in 4Q06. Asia/Pacific (excluding Japan), which continues to represent near 60% of Lenovo shipments, also performed well with growth increasing from the second half of 2006 to nearly 24%. Portables growth was the primary driver for Lenovo in the U.S. and abroad, but the company also managed to grow Desktop volume – even in the U.S. where volume was projected to decline by 8% and other vendors continue to struggle.

* Acer was boosted by a surge in EMEA during the first quarter. EMEA represented more than 60% of Acer shipments in the first quarter with growth above 50%, up from more than 30% in the second half of 2006. The company also continued a rapid expansion of its Americas business. The strong growth boosted Acer to a statistical tie with Lenovo for third rank in worldwide shipments.

* Toshiba saw growth slow to low teens from more than 20% in the second half of last year. Growth remained strong in EMEA and the Americas, but slowed in Japan and the rest of Asia/Pacific as a surge in shipments during 2006 made year-on-year comparisons more difficult.

* Gateway struggled with a difficult year-on-year comparison in addition to rising competition and a slow market in the United States. Gateway shipments increased by roughly 45% in 1Q06, compared with growth of 12% in 4Q05 and 17% in 2Q06. The surge in 1Q06 helped bring 1Q07 volume down by 6% year on year in the U.S. and by 9% worldwide. However, on a sequential basis, Gateway volume was down just 3% worldwide versus a market decline of 8.9%. Aside from the traditionally strong fourth quarter in 2005 and 2006, and an unusually strong 1Q06, the first quarter in 2007 was the highest volume quarter for Gateway since early 2001, when the dot-com bubble was just collapsing, and well before the acquisition of eMachines.

Top 5 Vendors, Worldwide PC Shipments, First Quarter 2007 (Preliminary)

Top 3 Vendors, United States PC Shipments, First Quarter 2007 (Preliminary)