“The uncertainty is caused by a combination of both positive and negative factors,” said OECD Chief Economist Pier Carlo Padoan. “But it is unlikely that we are heading into another downturn.”

While consumer spending is set to remain weak, a combination of robust corporate profits and low business investment suggest that capital spending is unlikely to weaken further. Because inventories are now close to desired levels, a renewed depletion of stocks is also unlikely.

Overall financial conditions have stabilised, the report notes, and growth remains strong in the major emerging-market economies.

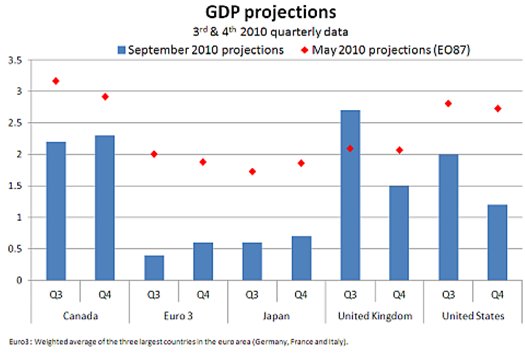

Based on the most recent data, the OECD short-term forecasting models show that US GDP is expected to rise by 2.0% in the third quarter but then moderate to 1.2% in the fourth quarter of 2010. In Japan, GDP growth is forecast at 0.7% in the fourth quarter after 0.6% in the third.

The combined GDP of the three largest countries in the euro area is projected to grow at 0.4% in the third quarter, rising to 0.6% in the fourth quarter. Second quarter 2010 GDP grew by 1.6% in the US; by 5.1% in the three largest countries of the euro area and by 0.4% in Japan.

Mr Padoan said that the current stance of both fiscal and monetary policy should remain on course. if the slowdown in the recovery becomes entrenched, and the risk of downturn increases, additional monetary stimulus in the form of quantitative easing and keeping interest rates close to zero for a longer period may be necessary. Countries with more fiscal space could also delay plans for fiscal consolidation.