"The decline had been expected in the second quarter, but consumer spending, energy profits and a strong economy kept it going," says Howard Silverblatt, Senior Index Analyst at Standard & Poor's. "The fourth quarter, however, reflected the impact of a slower economy, difficulties in the automotive and home building market, and strong holiday price competition in the electronic retail group."

Standard & Poor's data shows that as reported earnings for the S&P 500 posted a 17.0% gain during the fourth quarter to $20.24 per share from the $17.30 reported in 2005. For the year, as reported earnings increased 16.6% to a record $81.51, up from $69.93 in 2005.

In terms of aggregate dollars, both operating and as reported earnings posted their second highest earnings for a quarter at $197 billion (versus the record $207 billion in Q3 2006) and $182 billion (versus the record $193 in Q3 2006) respectively. For the year, both operating and as reported earnings reported their highest annual aggregates with operating posting $790 billion (versus $694 for 2005) and as reported posting $734 billion (versus $634 in 2005).

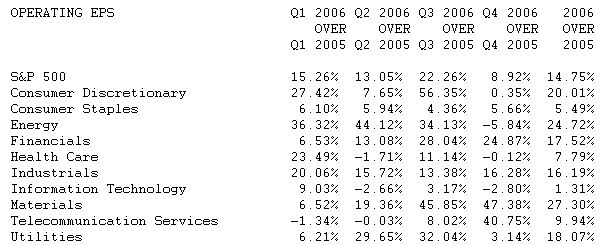

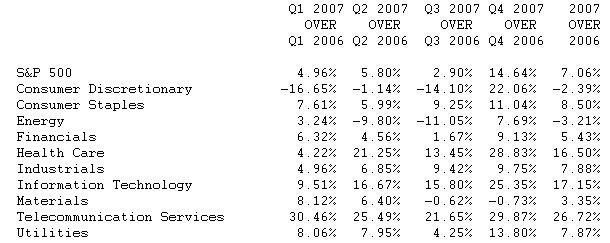

According to Standard & Poor's, sector performance varied significantly. Materials surged 47% for the quarter, partially due to a depressed Q4 2005 comparison, and Energy, with lower oil prices and harder compressions to their Q4 2005 earnings, reported a 5.8% decline. For the year, all ten sectors were positive with seven reporting double-digit gains. Information Technology, whose earnings were down in both the second (-2.66%) and fourth quarter (- 2.80%), reported a 1.3% gain for the year.

"Given that the four and half years of growth were the longest in index history, positive single-digit gains are probably as close to a perfect landing as we were going to get," concludes Silverblatt, discussing the S&P 500's fourth quarter single digit operating earnings.