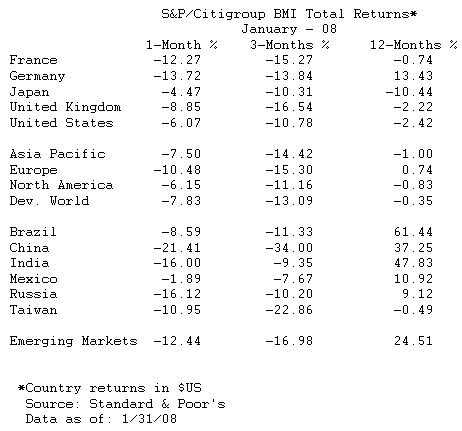

All 26 developed equity markets posted negative returns in January, with 16 losing at least 10% of their value. The January declines negated all previous market gains, leaving all of the developed markets in the red for the trailing 3-month period. Twelve-month returns were mixed with 15 developed markets in positive territory and eleven in the red (six with double-digit negative returns).

Despite gains by Morocco (+10.17%) and Jordan (+3.11%), the world's emerging equity markets were devastated in January, posting an average loss of 12.44%. Turkey was hit hardest during the month losing 22.70% followed by China (-21.40%), Russia (-16.12%) and India (-16.00%). Only five emerging markets remain positive for the 3-month period ending January. Only Argentina and Taiwan slipped into negative territory for the 12-month period.

All ten GICS sectors posted losses in January in contrast to October and September when all ten were in positive territory. Information Technology posted a broad 11.57% influenced mostly to U.S. losses (ex U.S. -9.48%). The Energy sector remained close behind at -11.45%. In general, non-U.S. Consumer related (Discretionary and Staples) issues did worse than their U.S. counterparts, as did Financials. Value (-6.98%) continued to outperform growth (-8.63%), although both declined for the month. Asian Pacific Growth dropped 15.95% and European Value declined 17.05% for the 3-month period.